Legislative Update – 5/9/19

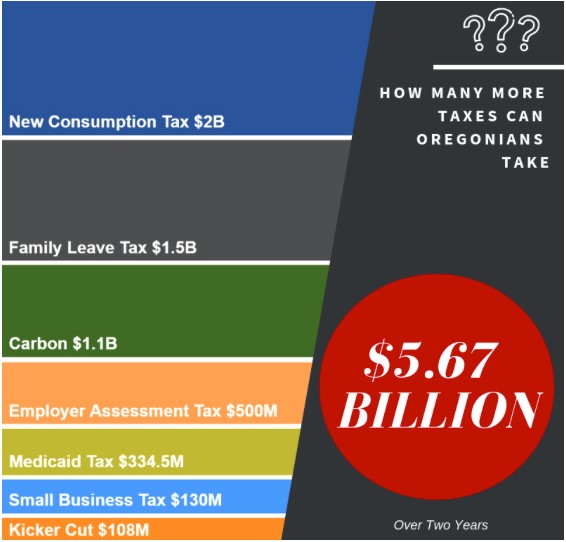

The graphic below illustrates the economic impact to Oregon resulting from the bills the legislature is currently discussing in Salem. Please write to your Senator (there is a link below) to let them know how this will impact you and your business. We estimate that it will cost each Oregon resident (each and every individual in the State) about $1,352 per biennium.

There are two major bills that are of focus as of now. First is the Commercial Activity Tax. Second, the Prevailing Wages in Enterprise Zones. There is information on both of those below, along with links. These links allow you to send messages to legislators, regarding how these bills will impact you and your business. We encourage you to write to them, as this will help show how this will affect businesses and the community of McMinnville.

- Commercial Activity Tax – HB 3427

The major issue that will be focused on this week in the Senate is the Commercial Activity Tax. This is a new $2 billion tax on a business’ gross receipts. The bill will allocate the $2.8 billion for education funding. It has the following components:

– A gross receipts tax rate of 0.57% on Oregon sales over $1 million

– A 35% deduction from taxable sales for labor OR business inputs, whichever is higher

– An exemption for receipts from sales to a wholesaler or agricultural cooperative for any sales outside of Oregon

– An exemption for groceries (defined as those that qualify for ‘SNAP’)

The total cost of proposed taxes, programs and fees being considered by the 2019 Legislature will raise $5.67 billion (as shown in the graphic above) over the next two years. Since the bill recently got voted out of the House, it is currently in the Senate to be discussed. Senate Republicans are highly opposed to this bill. While they do think that our education system needs adequate funding, they believe that there are more pressing issues that need to be focused on, for example the PERS issue. Senate Republicans have been a no show at the Senate in opposition to the bill stating they were not involved in the construction of the bill.

Please Respond regarding this bill here: https://www.votervoice.net/OSCC/campaigns/65435/respond?fbclid=IwAR0eieSeIHarBQ0PRXq1Di4r3WEOBCf92Bifn75vKhIz6pqzyhgCgTdf1Fs

- Prevailing Wages in Enterprise Zones – HB 2408

Requires prevailing wages on all private projects in Enterprise Zones in excess of $20 million. Such a policy erodes one of Oregon’s last remaining economic development tools. Along with that, it will put future investments in local economic development in jeopardy. Requiring prevailing wage rates n private construction projects offset the very local economic development incentives provided by tax abatements. By eliminating these incentive, private investors may decide against industrial expansion or may choose a site outside of the state. Many cities are opposed to this bill as it could hurt investment, especially in affordable housing and other building projects.

Please respond regarding this bill here: https://www.votervoice.net/OSCC/Campaigns/65819/Respond

Here are two other bills that are of importance:

- Workers Compensation Compromise – HB 3022

This piece of legislation would have upended 30 years of successful workers’ compensation reforms and drastically raised workers’ compensation costs on employers. However, this bill was heavily negotiated by SAIF so as to end up a compromise bill that won’t impact employer rates. The House Rules committee passed negotiated version of this last week, which likely eliminates a major threat to the business community.

- Lawsuit Damages – HB 2014

The Senate Judiciary Committee heard this bill on Monday. It would repeal Oregon’s legal limit of $500,000 on non-economic damages in personal injury and negligence lawsuit claims. Health care groups and business organizations have shown their opposition towards this bill because it is a significant factor in driving up health care costs and general liability costs for employers. There will be more of a push on this bill in the coming weeks.